Unlocking Insights from Ebsta’s 2025 Revenue Benchmark Report: Quota Performance and Predictable Growth

Estimated reading time: 4 minutes

Why Ebsta’s 2025 Revenue Benchmark Report Matters

Sales leaders everywhere are searching for predictability. Forecast misses, long deal cycles, and slipping win rates have made that harder than ever.

That’s why I was thrilled to host Guy Rubin, Founder of Ebsta and MD of Insights at Fullcast, for our latest webinar: Unlocking Insights from Ebsta’s 2025 Revenue Benchmark Report.

The report – based on more than 440,000 opportunities and $43 billion in pipeline data – reveals what’s really happening in go-to-market performance this year, and how revenue leaders can course-correct.

“76% of sellers missed quota in the first half of 2025 and just 14% are responsible for 80% of new revenue.” – Guy Rubin

Those numbers are stark. But Ebsta’s 2025 Revenue Benchmark Report also highlights what top-performing organisations are doing differently, and how every sales team can build predictable, scalable growth.

Quota Attainment Is Down, But the Lessons Are Clear

Ebsta’s 2025 Revenue Benchmark Report shows a continued downward trend in quota attainment for the second year running. Even as sales targets have eased slightly, fewer sellers are reaching them.

| Year | Avg Quota Change | % Sellers Hitting Quota | Sales Velocity Gap (Top vs Avg) |

| 2023 | +5% | 32% | 7x |

| 2024 | -4% | 28% | 9x |

| 2025 (H1) | -13% | 24% | 11x |

(Source: Ebsta’s 2025 Revenue Benchmark Report)

Despite lower targets, 76% of sellers still missed quota in H1 2025. Meanwhile, top performers are moving 11 times faster through their pipelines.

The takeaway? Sales efficiency has become a dividing line between growth and stagnation.

It’s no longer about activity – it’s about focus. Predictability comes from clarity on who to target and how to sell.

Predictable growth depends on a tighter, more disciplined pipeline. The teams succeeding right now are those concentrating effort where it counts.

Getting ICP Fit Right: Quality Over Quantity

One of the most revealing insights from Ebsta’s 2025 Revenue Benchmark Report is around ICP fit.

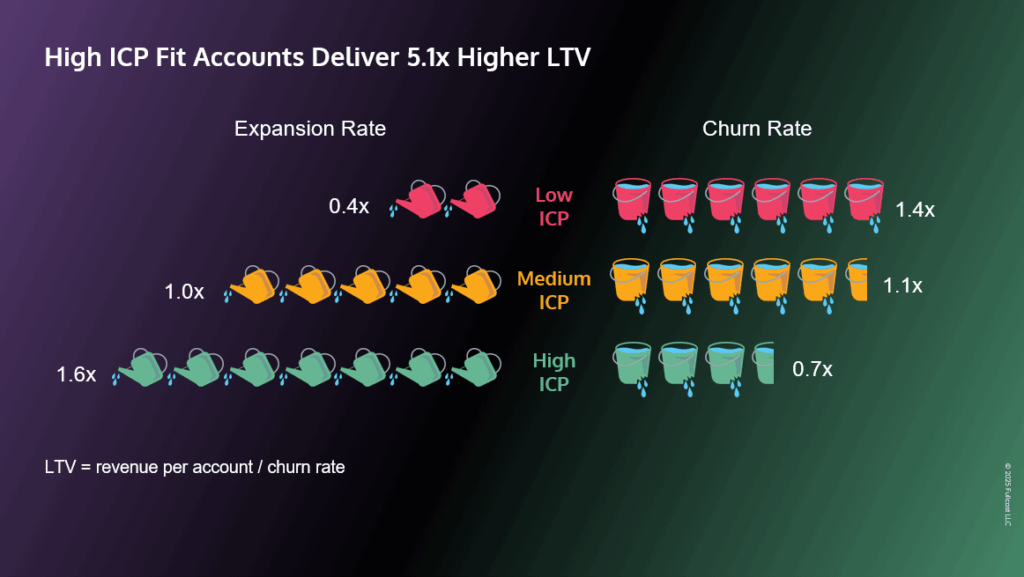

Companies that consistently target their Ideal Customer Profile are 8 times more efficient and achieve 5 times higher lifetime value. Yet only 23% of the average pipeline meets that definition.

“Not all deals are equal. Just because a company is in your market doesn’t mean they’re right for you.” – Guy Rubin

He shared Ebsta’s own experience. After narrowing their focus from smaller HubSpot customers to mid-market Salesforce users – their true ICP – they grew 25% quarter over quarter.

It’s a powerful reminder that growth isn’t about chasing volume; it’s about precision. Sometimes, saying no is the best commercial decision you can make.

Qualification: The Cornerstone of Predictable Sales

Another major theme in Ebsta’s 2025 Revenue Benchmark Report is qualification.

“When you slow down at the start, you speed up at the end.” – Guy Rubin

Highly qualified deals close 20% faster, are 1.9 times less likely to slip, and create far more reliable forecasts. Yet only 36% of deals pass discovery with proper documentation.

In my experience, this is where most sales teams stumble. Sellers often skip qualification because it feels like admin, but it’s the foundation of predictable revenue.

At durhamlane, our Selling at a Higher Level methodology embeds qualification throughout the process. It gives teams structure, consistency, and confidence in their pipeline.

Data-Driven Selling: Turning Insight into Impact

Data runs through every page of Ebsta’s 2025 Revenue Benchmark Report. The message is clear: instinct alone no longer wins.

“Data-driven selling isn’t the future, it’s already here” – Guy Rubin

By analysing CRM, email, and meeting data, Ebsta shows exactly what top performers do differently. For example, when finance stakeholders are engaged by stage two, win rates rise from 12% to 38%.

That’s the power of turning information into insight, and insight into repeatable performance.

Sales data shouldn’t just improve forecasting; it should improve behaviour.

Customer Growth and Partnerships: Revenue’s Quiet Powerhouse

One of the most encouraging findings from Ebsta’s 2025 Revenue Benchmark Report is the rise of customer expansion and partnerships as sustainable revenue sources.

More than half of new revenue (52%) now comes from existing customers.

Meanwhile, partner- and referral-driven deals are proving the most efficient paths to pipeline growth.

Guy shared that Ebsta spent 18 months building a partner programme before seeing results – but today, a third of their new revenue comes through partners.

The most cost-effective revenue you’ll ever generate is from the customers who already trust you.”

For sales leaders, the takeaway is clear: retention and partnerships aren’t side projects – they’re growth engines.

Watch the full webinar

Unlocking Insights from Ebsta’s 2025 Revenue Benchmark Report

Learn:

- What the latest benchmark data means for revenue leaders

- How ICP clarity drives efficiency and lifetime value

- Why qualification is the fastest route to predictable growth

- How data-driven selling is reshaping B2B performance